|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

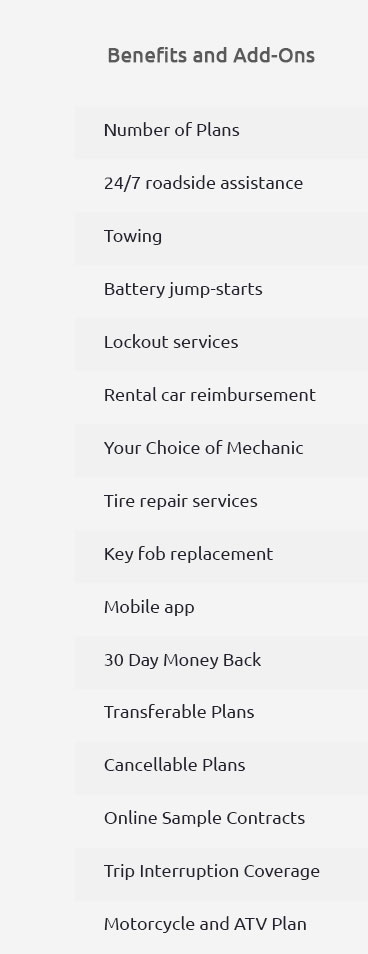

Car Warranty Broker: Comprehensive Coverage GuideWhen it comes to protecting your vehicle, understanding the role of a car warranty broker can be invaluable. These professionals assist U.S. consumers in navigating the complex world of vehicle protection, ensuring peace of mind and significant cost savings on repairs. Why Use a Car Warranty Broker?A car warranty broker acts as an intermediary between you and warranty providers, helping you find the best extended auto warranties that fit your needs and budget. Here are some key benefits:

By leveraging a broker's expertise, you can avoid common pitfalls and secure a plan that offers genuine value. Understanding Repair CostsCar repairs in the U.S. can be surprisingly expensive, especially for major components. Here’s a brief breakdown of average costs:

These figures highlight the importance of having a robust warranty plan that can cover such unexpected expenses. What’s Typically Covered?A good extended warranty often covers:

Some plans also offer added benefits like roadside assistance and rental car coverage. Special Considerations for Hyundai OwnersIf you drive a Hyundai, consider a Hyundai car extended warranty to ensure brand-specific parts and service. FAQWhat is a car warranty broker?A car warranty broker is a professional who helps consumers find and purchase extended auto warranties that best suit their needs and budget. How can a broker save me money?Brokers often have access to exclusive deals and can negotiate better terms with warranty providers, leading to cost savings for you. What should I look for in a warranty plan?Look for comprehensive coverage, fair pricing, and additional perks such as roadside assistance. Compare options through a broker for the best deal. For those considering financing options, exploring who sells gap insurance can provide additional financial protection. In summary, using a car warranty broker can significantly ease the process of securing a worthwhile extended warranty, offering peace of mind and financial protection against costly repairs. https://www.reddit.com/r/MechanicAdvice/comments/1fppzet/is_there_an_extended_car_warranty_company_that_is/

Manufacturer extended warranty is usually the best around. There is an aftermarket extended warranty company I see frequently that is good about coverage. https://www.youtube.com/watch?v=d4VHR0IMYcA

Ever wondered how third-party extended car warranty businesses actually make money? We break down an interesting deal in this episode! https://www.carchex.com/content/used-car-warranty-companies/

CARCHEX stands out as one of the best used vehicle protection companies, so we'd recommend considering one of our affordable but high-quality ...

|